Nigeria is back in the spotlight of Africa’s economic story.

Between 2024 and 2025, the government and the Central Bank of Nigeria (CBN) launched the country’s most ambitious reforms in decades, a plan to simplify the exchange rate system, rebuild investor confidence, and attract new foreign capital.

Led by Governor Olayemi Cardoso, the reforms aim to unify Nigeria’s multiple exchange rates, restore liquidity, and make the naira more transparent and market-driven (CBN, 2024; IMF, 2025). The goal is simple: create a stable FX system that investors can trust

The foreign exchange (FX) market is the global arena where currencies are traded, determining the real value of money. It is one of the most liquid and information-driven markets in the world, built on the idea that prices should reflect all available information at any given moment. This idea, known as the Efficient Market Hypothesis (EMH), suggests that when markets are transparent, informed, and accessible, prices become fair, speculation declines, and trust grows. In an efficient FX market, buyers and sellers act on equal information, demand and supply naturally set the rate, and no one can manipulate prices in the shadows. But Nigeria’s FX market, for many years, was the opposite of that ideal. It was fragmented, opaque, and dominated by administrative controls.

Multiple exchange-rate windows existed, each serving a distinct purpose, which created confusion and opened the door to arbitrage and corruption. Information did not flow freely, even basic data on rates, reserves, or inflows were inconsistent or delayed. The result was an economy where the naira’s value was often more political than economic. This lack of transparency weakened investor confidence, discouraged exporters, and drained liquidity from formal channels. The introduction of the Nigerian Foreign Exchange Code and the Electronic Foreign Exchange Matching System (EFEMS) is intended to address this issue. Together, they align Nigeria’s FX market with the principles of efficiency and transparency, integrating a system where prices are driven by real market activity, information flows openly, and policy credibility replaces uncertainty. In essence, Nigeria’s FX reform is not just about changing rates; it’s about changing how truth and trust circulate through the financial system.

Official exchange rate (LCU per US$, period average) – Nigeria | Data

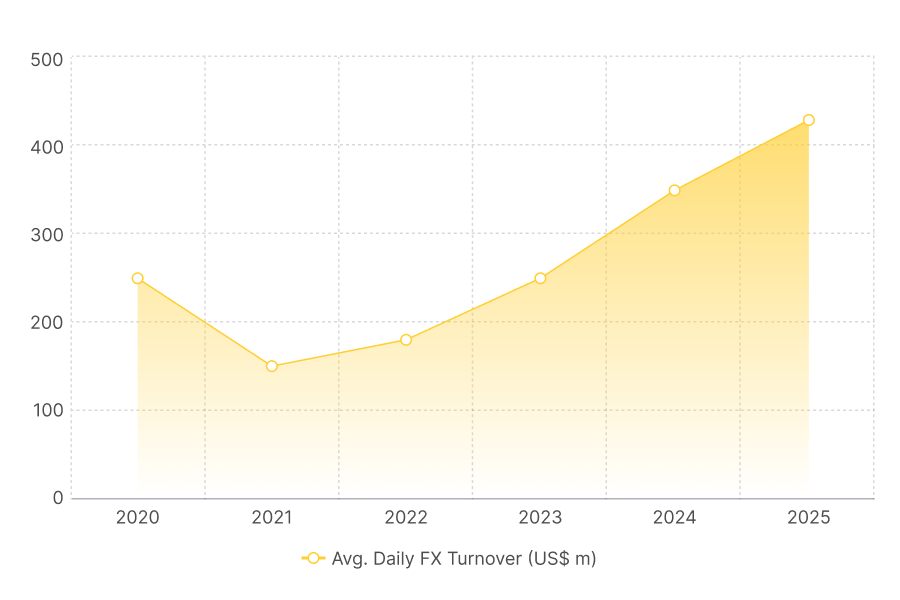

As the chart above shows, average daily FX turnover climbed from around US$150 million in 2021 to more than US$430 million by 2025, the highest in over a decade. This steep recovery coincides with the launch of the Electronic Foreign Exchange Matching System (EFEMS) in 2023, which digitalised order matching and improved transparency.

Historical Trajectory of the FX System

Nigeria’s path to this point has been long, uneven, and often painful.

In 1995, the CBN created the Autonomous Foreign Exchange Market (AFEM), its first real attempt at liberalisation. Banks bought dollars from the CBN and sold them to end-users at “market” rates, though the Bank still heavily influenced pricing. The average daily turnover was then just US$20–50 million (CBN, 1996). Liquidity was scarce; businesses relied on the black market to survive.

By 1999, the Interbank Foreign Exchange Market (IFEM) enabled banks to trade foreign currencies among themselves, increasing daily turnover to approximately US$100–150 million (CBN, 2001). Still, most dollars came from the CBN, not private inflows.

Between 2002 and 2015, Nigeria used Dutch Auction Systems (RDAS & WDAS). The CBN held auctions twice a week, selling approximately US$200–300 million per week to banks and importers (FDC, 2014). Transparency improved marginally, but dependence on central intervention deepened.

In 2016, the Bank introduced a managed-float system, designed to allow the naira to move in line with market forces. But on paper, flexibility turned into real-world control. The CBN continued to ration dollars and fix prices, keeping the official rate far below the actual rate. By 2021, the Investors’ and Exporters’ (I&E) window averaged ₦410–₦420/$, while the parallel market crossed ₦570/$ (Reuters 2021). Remittances slowed, exporters avoided official channels, and total market turnover fell below US$35 billion per year, a decline of almost 40 per cent from 2018 (FMDQ 2022).

Then came 2023, the year of reset. The Tinubu administration backed full FX unification, and the CBN implemented the “willing buyer, willing seller” system. All windows — official, I&E, BDC, and others- were consolidated into a single market. The naira was allowed to float freely; the rate jumped from ₦460 to ₦760, a painful adjustment but a necessary one (Reuters, 2023).

To ensure discipline, the CBN launched the Electronic Foreign Exchange Matching System (EFEMS), a digital order-matching tool that links banks and dealers in real-time. By March 2024, average daily turnover had risen to US$350 million, the highest since 2014 (FMDQ 2024). By year-end, total monthly volumes exceeded US $7 billion, and Nigeria’s net reserves stood at US $23 billion (IMF 2025).

How the Reforms Work

In mid-2023, the CBN started to close these gaps, clearing old FX backlogs and allowing the market rate to play a bigger role. By early 2024, it had merged the windows and adopted a more flexible and transparent pricing system (BNP Paribas, 2024).

According to the CBN’s Macroeconomic Outlook (March 2024):

“Ongoing efforts to improve efficiency, transparency, and confidence in the foreign-exchange market are expected to boost remittances through formal channels.”

The message was clear: end fragmentation, rebuild trust, and let supply and demand determine the naira’s value.

What the Data Shows

By April 2024, Nigeria’s external reserves stood at US$32.8 billion, equivalent to approximately 7.2 months of import cover (CBN, 2024). The naira traded around ₦1,235.80/US$, reflecting the shift toward open-market pricing.

Nigeria Foreign Exchange Reserves

The FX reform has also strengthened Nigeria’s external buffers. Gross reserves grew from roughly US$35 billion in 2021 to over US$43 billion in 2025, showing that despite higher FX demand, inflows from remittances, oil exports, and portfolio investments are replenishing reserves. The IMF (2025) notes that Nigeria’s “strong external position” and credible FX policy underpinned this rebound.

By December 2024, Reuters reported US$23.1 billion in net FX reserves, the highest in almost three years, a sign that the reforms were beginning to stabilise the external position (Reuters 2024).

The Nigerian Exchange Group (NGX) also recorded renewed activity. In September 2024, total market transactions reached ₦493 billion (~ US$307 million), representing an approximately 30 per cent month-on-month increase, with foreign investors contributing ₦41 billion (NGX, 2024).

Research from BNP Paribas estimated US$3.4 billion in net capital inflows in Q1 2024, about 61 per cent from portfolio investors, while an SSRN (2024) paper found that higher interest rates “spur portfolio inflows and can help stabilise the exchange rate.”

By mid-2025, the IMF confirmed that Nigeria had “a strong external position, reserves increased, FX reforms supported naira stability, and investor sentiment improved” (IMF 2025).

Early Results and Market Reactions

The changes have started to reshape both policy and perception.

With a unified FX rate, investors now have a clearer picture of the naira’s value. Transparency has replaced guesswork, and liquidity in the formal market is improving. Trading volumes on the NGX have risen, and capital inflows are returning. The IMF reported that Nigeria’s balance of payments swung into surplus in 2024, reflecting improved foreign exchange management (IMF, 2025).

Still, the transition isn’t smooth. Inflation remains high, and short-term volatility continues as the market adjusts. A 2025 paper by Theophilus (2025) warns that rate unification can temporarily increase prices as fuel subsidies are removed and imports become more expensive (RSIS International, 2025).

What This Change Means for the Total Economy and Government

The FX reform has begun to reshape Nigeria’s entire macro-economic landscape.

A transparent, unified exchange-rate regime enhances credibility, improves fiscal forecasting, and strengthens external buffers.

For the government, a market-determined rate means truer revenue conversion. In 2024, oil receipts converted at ₦1,200–₦1,400 per US $ generated roughly ₦12 trillion more in naira terms than if calculated at the pre-reform rate of ₦460 (CBN Fiscal Bulletin, 2024). This higher naira valuation boosted public-sector revenue and narrowed the fiscal deficit from 6.1 per cent of GDP in 2023 to 5.0 per cent in 2024 (IMF 2025).

Improved investor sentiment also lowered sovereign risk. Yields on Nigeria’s 2031 Eurobond fell 80 basis points between Q3 2024 and Q1 2025 (Bloomberg, 2025), signalling renewed trust in macro stability. The unified FX system has also enhanced monetary-policy transmission: interest-rate adjustments now influence inflation more predictably because currency pricing reflects real market demand rather than rationed supply.

What It Means for Businesses and Investors

For businesses, the reform replaces unpredictability with transparency, but also exposes them to real market forces. Importers can now access dollars more easily, but they must plan for price swings: the naira will trade between ₦1,200 and ₦1,600 per US$ $ in 2025. Exporters and diaspora remittance senders, on the other hand, are benefiting from fairer conversion rates. Formal remittance inflows rose 18 per cent YoY to US $21 billion in 2024 (World Bank, 2025).

For investors, Nigeria is again a high-return, high-risk frontier. Local T-bill yields remain above 20 per cent, and real yields on naira bonds have turned positive for the first time in five years. Portfolio inflows rose to US$3.4 billion in Q1 2024, up 61 per cent from 2023 (BNP Paribas 2024). At the same time, listed equity market capitalisation reached ₦40 trillion (≈ US $27 billion), up 45 per cent year-on-year (NGX 2024).

However, volatility remains. Inflation hovered around 28 per cent (YTD NBS 2025), eroding purchasing power. The businesses that will thrive in this new environment are those that hedge FX exposure, align revenues and costs in the same currency, and strengthen financial governance.

What It Means for GDP and Growth

Exchange-rate reforms have a direct impact on GDP composition and real growth. The IMF (2025) estimates Nigeria’s real GDP growth at 3.3 per cent in 2024 and 3.8 per cent in 2025, up from 2.9 per cent in 2023, attributing the rebound partly to restored FX liquidity and rising non-oil exports. A more realistic exchange rate is stimulating domestic production by making imports costlier and exports more profitable. Agricultural and manufacturing output grew 4.2 per cent and 2.9 per cent, respectively, in 2024 (NBS 2025).

Services, now accounting for 58 per cent of GDP, benefited from increased financial-sector activity and digital payments tied to formal foreign exchange transactions.

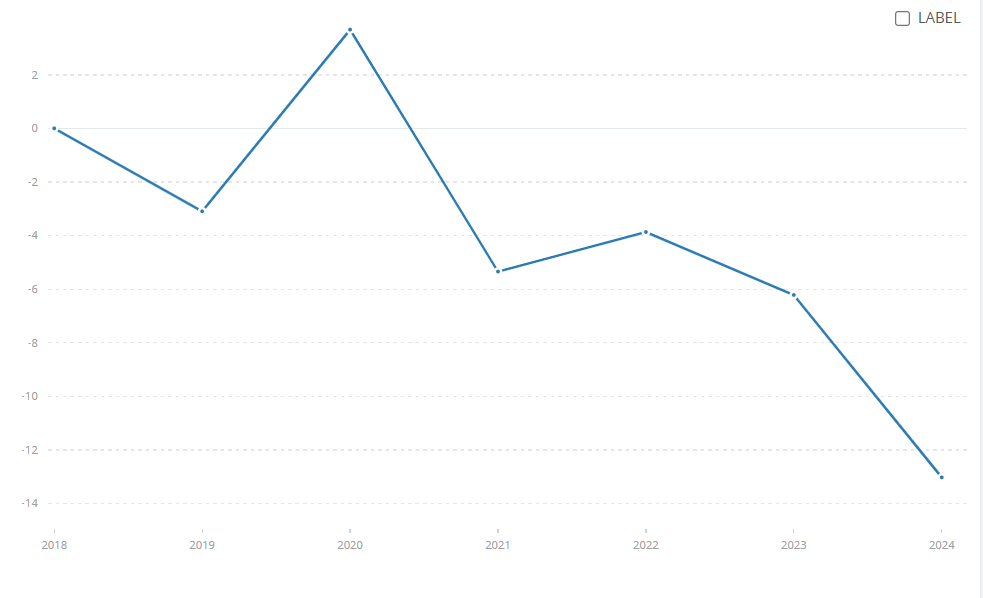

Portfolio Investment, net (BoP, current US$) – Nigeria | Data

Nigeria’s portfolio inflows have demonstrated resilience, starting at 0% in 2018 before dipping slightly to around –3% in 2019. The strong rebound to about +3% in 2020 shows how investor appetite returned quickly despite global shocks. Even after the decline to roughly –6% in 2021, the market recovered to –4% in 2022 as reforms improved clarity and access.The softening to –6% in 2023 was short-lived, setting the stage for the significant improvement.By 2024, portfolio inflows surged to about –14%, reflecting increased market activity and renewed interest driven by Nigeria’s FX and capital-market reforms.

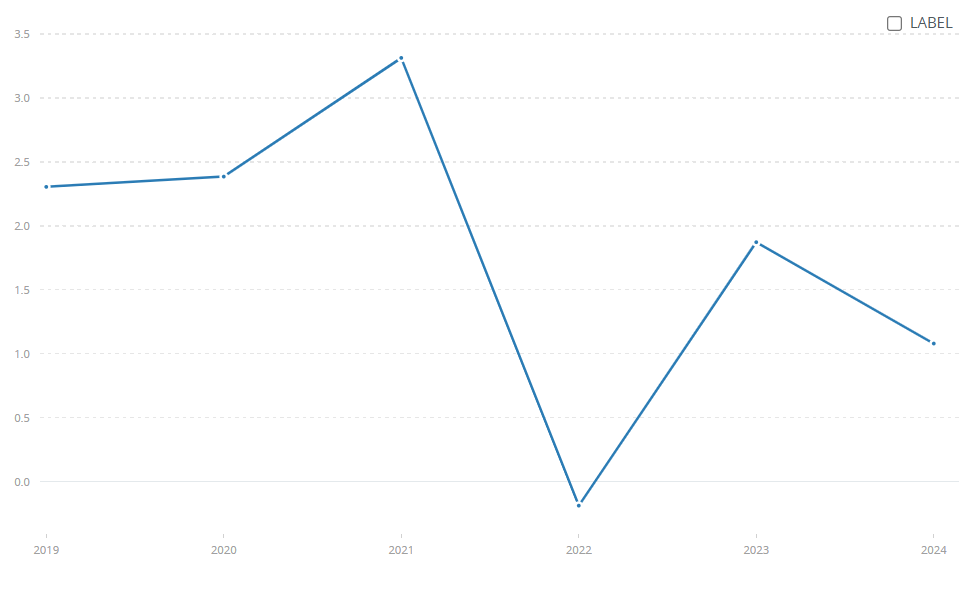

Moreover, foreign direct investment (FDI) inflows rose to US$1.5 billion in 2024, the highest since 2019 (IMF, 2025). The unified system is also supporting fiscal consolidation: higher naira revenues from oil exports improved the government’s debt-to-GDP ratio from 38 per cent to 36 per cent between 2023 and 2024 (MoF 2025).

Foreign direct investment, net inflows (BoP, current US$) – Nigeria | Data

Nigeria’s portfolio investment inflows remained strong in the early years, rising from $2.3 billion in 2019 to about $2.4 billion in 2020, before climbing further to $3.3 billion in 2021. The sharp dip to roughly $0.1 billion in 2022 reflects global tightening and domestic FX constraints rather than a loss of investor interest. Crucially, inflows rebounded quickly to $1.85 billion in 2023, showing renewed confidence as reforms began taking effect. By 2024, inflows stabilised at around $1.1 billion, indicating that foreign investors are re-entering the market gradually. Overall, the chart highlights Nigeria’s ability to recover from shocks and regain investor attention as macro-financial reforms improve clarity and market access.

What It Means for Trade

Trade is perhaps the most immediate beneficiary of the FX reset. By allowing the naira to find its true value, exports have become more competitive while imports have adjusted to realistic pricing. In 2024, Nigeria’s total exports surged 38 per cent year-on-year to US$67 billion, driven by crude oil and agricultural commodities (NBS, 2025).

Non-oil exports reached a record US$4.8 billion, led by shipments of cocoa, cashew, and fertiliser (CBN Trade Data 2024). Imports, meanwhile, declined 11 per cent to US$52 billion, as the weaker naira encouraged local substitution.

The trade balance swung from a US$3.2 billion deficit in 2022 to a US$15 billion surplus in 2024 (IMF 2025). Formal remittances and export proceeds now supply over 60 per cent of FX liquidity, reducing reliance on CBN interventions.

This structural improvement in the trade account has stabilised the current account, supported the naira, and rebuilt reserves, clear evidence of an efficient market beginning to self-correct.

The Road Ahead

To build lasting confidence, Nigeria should continue merging its FX windows and publish regular, transparent FX data. The CBN should expand the range of naira-denominated bonds that foreign investors can buy to convert short-term inflows into long-term capital.

Investors should view Nigeria as a reform story still in progress: diversify holdings, hedge FX exposure, and prioritise issuers with solid governance. Corporations, in turn, must “FX-proof” their operations by aligning revenue and expenses in the same currency and maintaining buffers against inflation and rate shocks.

Conclusion

Nigeria’s FX and capital-flow reset marks a major turning point. The country is shifting from opaque exchange-rate regimes and limited capital access to a more transparent and liquid system.

Challenges remain, inflation, structural reform, and policy consistency, but the early signs are encouraging. If the reforms are implemented, Nigeria could once again become one of Africa’s most attractive destinations for portfolio capital, combining high yields with a steadily stabilising currency.