Intra-African trade 2024 marks a new era of economic collaboration across the continent. Africa’s economies are trading more with each other than ever before, with trade between African countries surpassing US$220 billion. This surge is driving regional growth, creating jobs, adding value to locally produced goods, and strengthening supply chains. As nations connect markets across borders, Intra-African trade 2024 highlights the continent’s growing economic integration. It underscores Africa’s increasing ability to build resilience and prosperity from within.

Trade Overview

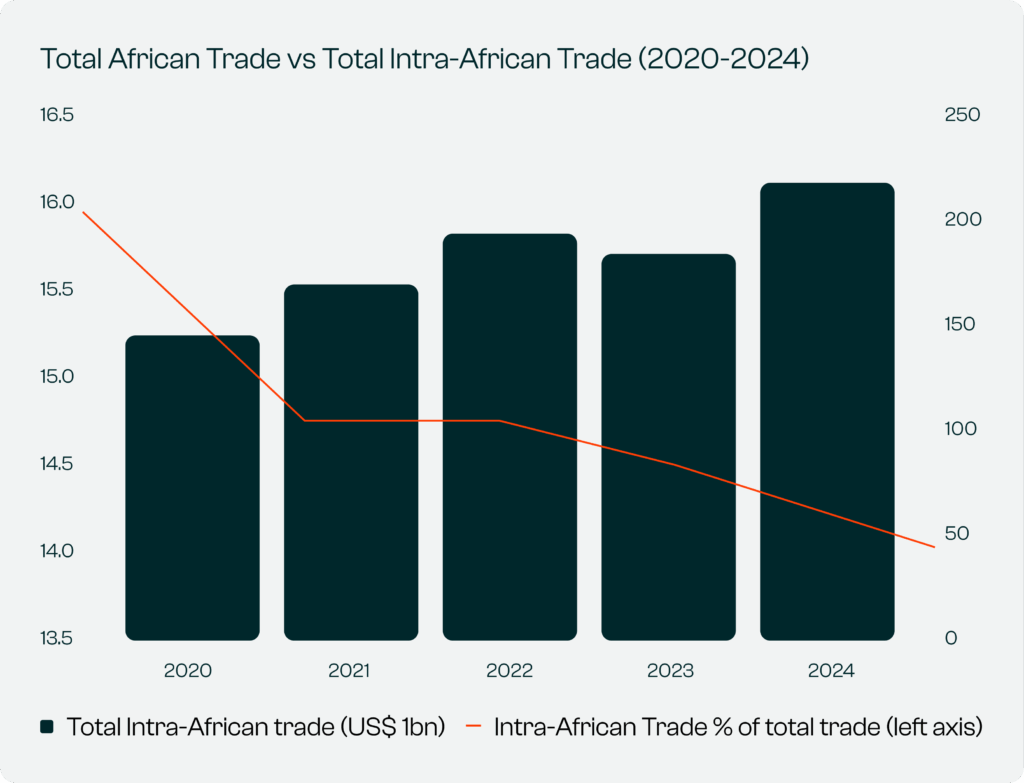

In 2024, intra-African trade surged to an estimated US$220.3 billion, reflecting a 12.4% year-on-year growth. This marked a strong rebound from the 5.9% contraction recorded in 2023. Despite global headwinds, including slower global growth and volatile commodity prices, African trade within the continent proved remarkably resilient. The share of intra-African trade in total African trade eased only slightly, from 14.7% in 2023 to 14.4% in 2024. This indicates that regional trade linkages remain strong despite a challenging global environment.

Regional Performance

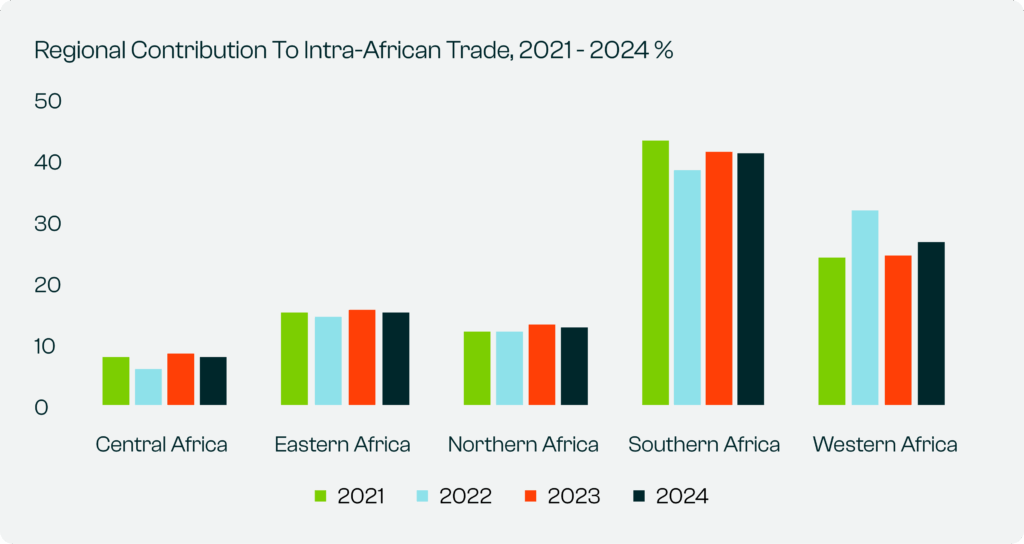

While overall growth was broad-based, regional dynamics varied significantly:

- Southern Africa remained the largest contributor to intra-African trade. This was driven by South Africa’s strong regional links through the Southern African Customs Union (SACU) and SADC.

- West Africa consolidated its position as the second-largest intra-African trading region, boosted by Côte d’Ivoire, Nigeria, and Mali.

- East Africa followed as the third-largest, led by Kenya and Tanzania.

- North and Central Africa maintained moderate but steady contributions.

Country Highlights

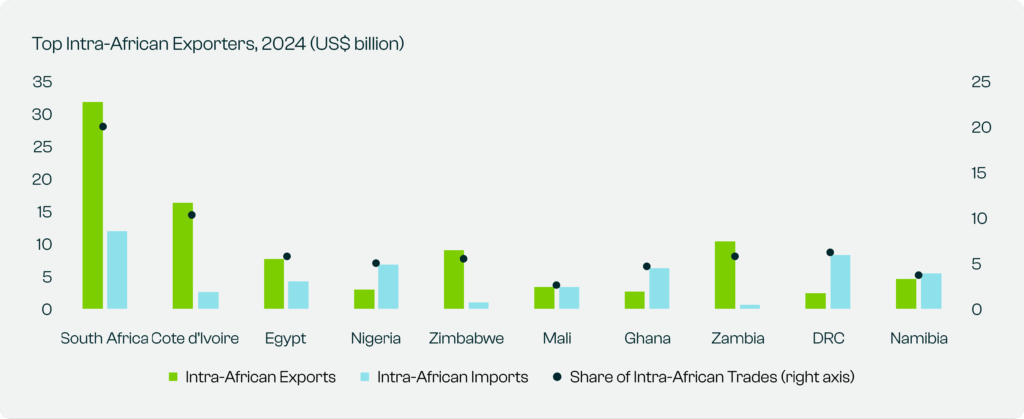

South Africa: Continental Trade Leader

South Africa strengthened its position as Africa’s top intra-African trader in 2024. Trade flows reached US$42.1 billion, 7.5% higher than the previous year. This accounted for 19.1% of total intra-African trade, slightly below its three-year average of 19.4%. African partners represented 11.8% of South Africa’s imports and 24.6% of its exports. This reflects sustained trade ties with Mozambique, Botswana, Zimbabwe, Namibia, and Zambia.

West Africa: Emerging Growth Hub

Côte d’Ivoire’s intra-African trade rose sharply in 2024, contributing 4.8% of total continental trade. This growth was driven by rising exports of refined petroleum and manufactured goods. Nigeria also rebounded after a slower 2023, benefiting from renewed industrial and export activity.

Other Key Players

- Morocco showed solid recovery, expanding its intra-African trade footprint, especially in manufacturing and energy equipment.

- Ethiopia and Côte d’Ivoire experienced mixed results due to domestic economic pressures but remained integral to regional trade corridors.

Drivers of Intra-African Trade (2024)

Overview

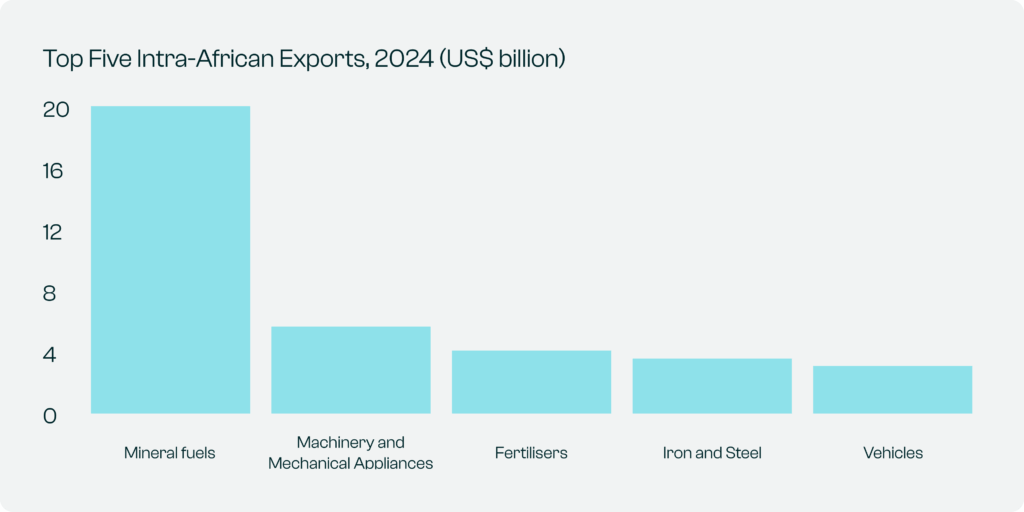

In 2024, intra-African trade continued to diversify, with a steady shift from raw commodities toward manufactured and value-added products. Although mineral fuels remained the largest traded category, industrial output continued to rise across the continent. Stronger logistics networks and expanding regional value chains signaled a gradual shift toward technology-driven and higher-value trade.

Southern Africa: Industrial Strength

Southern Africa remained the continent’s trade powerhouse, led by South Africa’s diversified industrial exports. Imports were dominated by crude oil, coal, electricity, and food products from neighbours such as Eswatini, Zambia, and Mozambique. Exports, on the other hand, featured machinery, vehicles, iron and steel, and agricultural products. Machinery and transport equipment alone accounted for over 30% of South Africa’s exports to African markets. This underscores its role as the region’s industrial anchor within SACU and SADC.

West Africa: Refining and Energy Trade

In Côte d’Ivoire, refined petroleum products continued to drive intra-African trade. Oil was imported from Nigeria and re-exported to Burkina Faso, Ghana, and Mali. The country also diversified into fertilisers, seafood, edible oils, and plastics as domestic demand rose. In Nigeria, the launch of the Dangote Refinery marked a major turning point. It enabled the country to export refined fuels directly to regional markets such as Cameroon. This reduced reliance on imports and strengthened energy security across West and Central Africa.

Central Africa: Mineral Powerhouse

The Democratic Republic of Congo (DRC) continued to dominate Central Africa’s trade through exports of copper and cobalt. These minerals are essential for Africa’s industrialisation and global clean-energy supply chains. Most exports moved via rail to Durban and through Dar es Salaam and Mombasa for eastern routes. This highlights the critical role of logistics infrastructure in regional trade.

South Africa remained the DRC’s main African trading partner for industrial imports such as machinery and pharmaceuticals.

North Africa: Manufacturing Expansion

Egypt strengthened its role as North Africa’s manufacturing and export hub. In 2024, its exports included cement, gypsum, plastics, and flour, primarily to Libya, Sudan, Algeria, Morocco, and Kenya. Imports from Africa, on the other hand, centred on copper, coffee, and spices.

The Egyptian government conducted over 200 trade missions to sub-Saharan markets in 2024. It also established new logistics centres to enhance trade efficiency and regional access.

Africa’s trade story is shifting from dependence to interdependence. The surge in intra-African trade to over US$220 billion in 2024 highlights strong regional growth. Despite global volatility, the continent’s economies are learning to trade more with each other and to trade smarter. Regional value chains are deepening, and industrial output is diversifying. Infrastructure links from Cairo to Cape Town are slowly stitching together a unified market.

South Africa remains the industrial anchor of the continent. However, rising hubs like Côte d’Ivoire, Nigeria, and Egypt are redefining Africa’s manufacturing and energy landscape. The steady shift toward refined, value-added, and technology-driven goods is transforming Africa’s trade landscape. It signals that the foundations of the African Continental Free Trade Area (AfCFTA) are firmly taking hold.

What began as a policy vision is now a visible economic transformation. It is proof that when Africa trades with itself, it grows together.